MSA Lab: Advancing Market Surveillance with High-Energy Physics Tools

For the past several years, the Market Surveillance Analytics (MSA) Lab has been developed as part of project HighLO. By applying computational techniques originally designed for high-energy physics, the MSA Lab provides regulators and exchanges with a scalable, transparent, and scientifically rigorous approach to detecting market manipulation.

Bridging High-Energy Physics and Financial Market Analysis

Financial markets generate vast amounts of high-frequency data, requiring efficient, high-performance analysis methods to detect anomalies. Many of the challenges faced in market surveillance, such as identifying rare patterns in large datasets, are similar to those encountered in particle physics. The MSA Lab leverages ROOT, a data analysis framework developed at CERN, to bring high-speed processing and statistical precision to financial market surveillance.

Key Features of the MSA Lab

-

High-frequency data processing with ROOT: Handling large-scale financial data requires specialized tools. ROOT, originally designed to process petabytes of data from particle physics experiments, enables the MSA Lab to analyze market activity at the microsecond level, ensuring detailed and accurate detection of manipulative behavior.

-

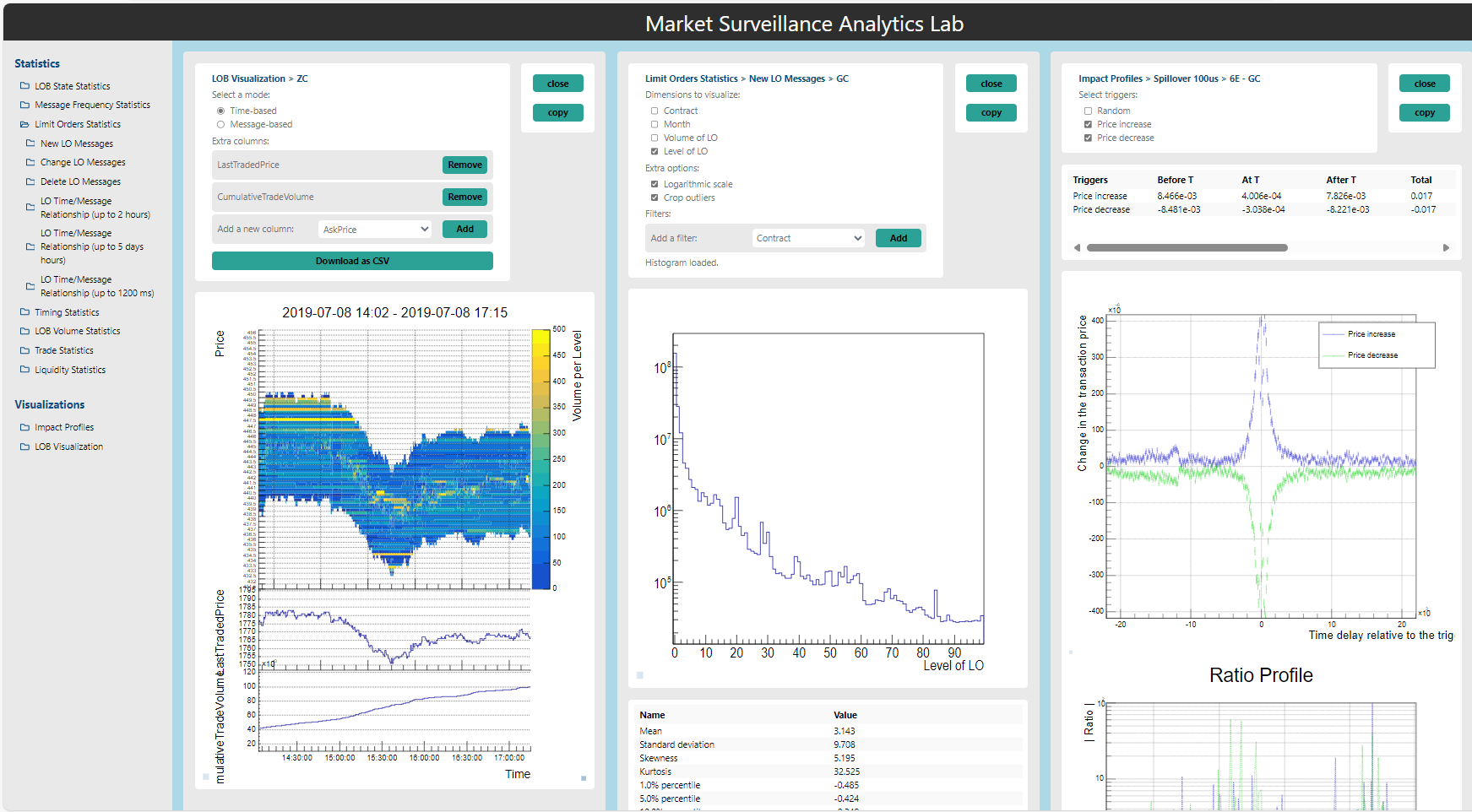

Interactive market visualizations: Understanding market behavior requires more than just raw data—it requires intuitive visualization tools. The MSA Lab includes an interactive limit orderbook visualization module, allowing regulators to explore trading patterns across different time scales, from high-level trends to individual transactions.

-

Measuring the market impact on a microsecond level: Market events do not occur in isolation. The impact profile module in MSA Lab allows regulators to analyze how specific market events, such as price movements, affect other markets over time. This provides deeper insights into interdependencies and potential spillover effects.

-

Rule-based manipulation detection: The MSA Lab identifies market manipulation using clearly defined statistical rules, avoiding black-box AI models.

-

A transparent and customizable framework: Unlike many existing market surveillance systems, MSA Lab prioritizes transparency and customizability. Regulators and exchanges using the system gain full access to the source code, ensuring that methodologies can be validated and tailored to specific market needs.

Designed for Regulators and Exchanges

The MSA Lab is designed exclusively for regulators and regulated exchanges, with access provided through the International Epert Group on Market Surveillance (IMS Group). Unlike commercial compliance tools, it is not available to private trading firms, ensuring that the methodologies used for detecting market manipulation remain secure and cannot be exploited.

Advancing Market Surveillance Through Scientific Collaboration

The MSA Lab represents a continued effort to apply scientific methodologies to financial markets, demonstrating the value of interdisciplinary collaboration between finance and high-energy physics. By integrating advanced data analysis techniques into market surveillance, it enables regulators and exchanges to enhance efficiency, accuracy, and transparency in detecting market manipulation.

Try the demo hosted at CERN

A demo version of the MSA Lab is hosted at CERN, showcasing key functionalities including high-frequency data visualization, impact analysis, and manipulation detection. This demo allows prospective collaborators to explore the platform’s capabilities and evaluate its potential for regulatory use.

To request access or discuss potential collaboration, please contact info@highlo.org.

The demo requires a CERN light account, instructions will follow after access is granted.